An everyday example of accounts receivable would be an electric company that bills its clients after the clients receive and consume the electricity. The electric company records an account receivable for unpaid what is the quick ratio definition and formula invoices as it waits for its customers to pay their bills. As the name would suggest, average accounts receivable reflects the average value of debts owed to your business by its customers over a given period.

What is Accounts Payable?

The allowance for doubtful accounts will help to reflect the actual value on the accounts receivable that the company have (accounts receivable – allowance for doubtful accounts). After all, the receivables that the customer is not going to pay have no value as they are the assets that have no economic benefits inflow to the company. For unpaid accounts receivable, the next step would be either to contact the customer or contracting a collection agency to do so.

What is Accounts Payable? (Definition and Example)

As a seller, you must be careful when extending trade credit to your customers, as you run the risk of non-payments attached to accounts receivables. The customers who may not pay for the goods sold to them are then recorded as bad debts in the books of accounts. Accounts receivable are recorded when the company sells its goods or services on credit to customers. Likewise, the accounts receivable are the current assets that are shown on the balance sheet for which the balances are due within one year. Accounts receivable is one of the most important line items on a company’s balance sheet.

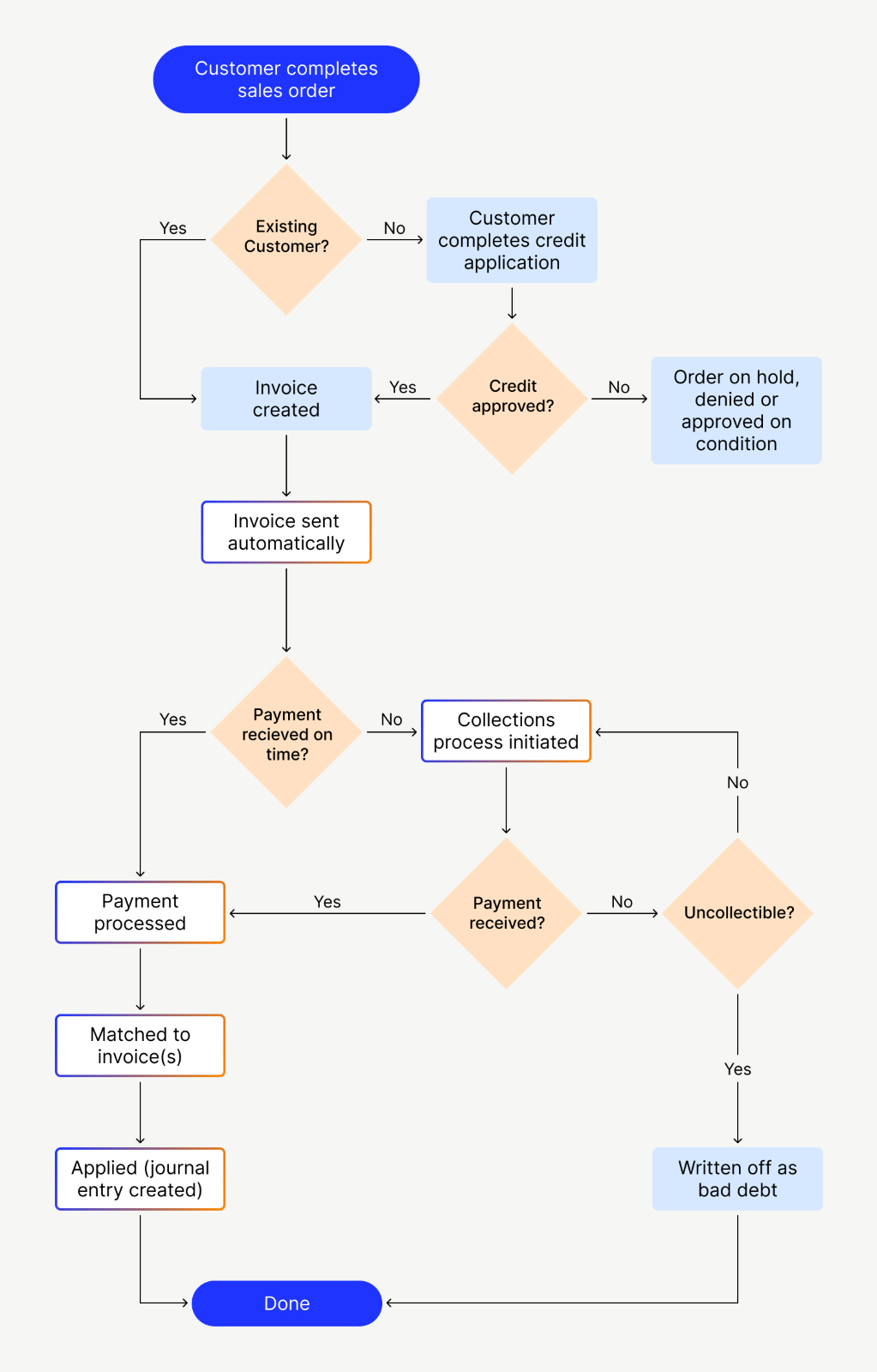

Accounts Receivable Process: Step-By-Step Guide

- Yes, accounts receivable should be listed as an asset on the balance sheet.

- Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University.

- But businesses that sell big-ticket or bulk items might not get paid for months.

- Later, when a specific invoice is clearly identifiable as a bad debt, the accountant can eliminate the account receivable with a credit, and reduce the reserve with a debit.

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

- Automating your Accounts Receivable increases accuracy and efficiency, saving your business time and money while improving the customer experience.

Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. Unless you require advanced payments or deal with cash on delivery (COD) sales only, you must record these credit-based transactions as A/R within your general ledger and corporate balance sheet. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past.

Overview of Accounts Receivable

Contingent (or potential) rights to collect may be disclosed in footnotes if they are material and if sufficient information is provided to allow the reader to understand the contingency. Generally, only existing legal rights are disclosed in the body of the balance sheet. Get instant access to video lessons taught by experienced investment bankers.

Understanding Accounts Receivable (AR)

We’ll also look at key performance indicators and automation options to help you streamline your Accounts Receivable system. Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University. If you’re running your own Shopify store, you might need a better accounting solution.

These amounts are considered due in the short term, so it’s assumed that customers will be paying soon. As the goods or services have already been provided under specific terms, the debts in Accounts Receivable are legally binding. Since the funds are legally due to the business and can be used as collateral for loans, the money owed in Accounts Receivable is considered a liquid asset. The accounts receivable aging report itemizes all receivables in the accounting system, so its total should match the ending balance in the accounts receivable general ledger account. The accounting staff should reconcile the two as part of the period-end closing process.

To help financial statement readers assess a company’s earning power, GAAP call for the reporting of interest income earned from receivables and the losses incurred through non-collection. Fine-tuning your accounts receivable process is a must, especially if you want your business to get paid in a timely manner. For example, you would have accounts receivable if you invoice a customer for a sale on credit, and they pay at a later date. The company must identify the source of the rising accounts receivable balance (e.g. collection issues) and adjust accordingly if deemed necessary. With that said, an increase in accounts receivable represents a reduction in cash on the cash flow statement, whereas a decrease reflects an increase in cash.

The term remote is used here, consistent with its use in Topic 450, to mean that the likelihood is slight that a loan commitment will be exercised before its expiration. Receivables are normally current assets, but some may have a non-current portion depending on their maturity. Schedule a demo to observe how our Smart Chasing technology can make your dunning efforts consistent and seamless, spanning email, text, phone, and more. Or explore the software’s integrated self-service customer portal that can standardize and simplify the payment process for both parties. Our invoicing engine can handle the most complex workflows, performing validations, discount management, and dispute resolution without drawing in your staff. For bookkeeping, consider A/R an asset that is both liquid (can be easily converted to cash) and current (will be resolved through regular business over the next year).

A/R Aging report is very useful in making allowance for doubtful accounts. Usually the longer the overdue the more likely that the customers are not going to pay back the money. Allowance for doubtful accounts is used for making provisions on the receivables. As a result, the amount of receivables is reduced by the provisioning amount.

Tracking this metric can help businesses assess areas where it can improve its Accounts Receivable process. The IRS’s Business Expenses guide provides detailed information about which kinds of bad debt you can write off on your taxes. A quick glance at this schedule can tell us who’s on track to pay within 30 days, who’s behind schedule, and who’s really behind. Our team is ready to learn about your business and guide you to the right solution.